Auto Insurance

Auto insurance is a requirement for all car owners in Texas, as it helps to protect them financially in case of an accident. The State of Texas requires all drivers to have liability insurance coverage, which covers damages and injuries that you may cause to others in an accident. However, drivers can also opt for additional types of coverage that offer greater protection and peace of mind. Below are the different types of auto insurance available in Texas and what you need to know to make an informed decision about your coverage.

Types of Auto Insurance

Liability coverage: Is the minimum requirement for auto insurance in Texas. This type of coverage pays for damages and injuries that you may cause to others in an accident. In Texas, the minimum liability insurance requirements are $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage. However, it is important to note that these are only the minimum requirements, and you may need more coverage depending on your circumstances.

Collision coverage: Pays for damages to your vehicle in case of an accident. If you have a car loan or lease, your lender or lessor may require you to have collision coverage. Collision coverage is not required by Texas law, but it can be a valuable investment to protect your vehicle.

Comprehensive coverage: Pays for damages to your vehicle that are not caused by a collision. This can include damages from theft, vandalism, weather events, and more. Comprehensive coverage is also not required by Texas law but can be a worthwhile investment to protect your vehicle.

Uninsured/underinsured motorist coverage: Is very important to consider in Texas. This coverage protects you if you are in an accident with a driver who does not have sufficient insurance to cover your damage and injuries. It can also provide coverage if you are in a hit-and-run accident. Uninsured/underinsured motorist coverage is not required by Texas law, but it is recommended to protect yourself in case of an accident with an uninsured or underinsured driver.

Personal injury protection (PIP): Pays for medical expenses and lost wages in case of an accident, regardless of who was at fault. PIP is not required by Texas law, but it can be a valuable investment to protect yourself and your passengers in case of an accident.

Rates

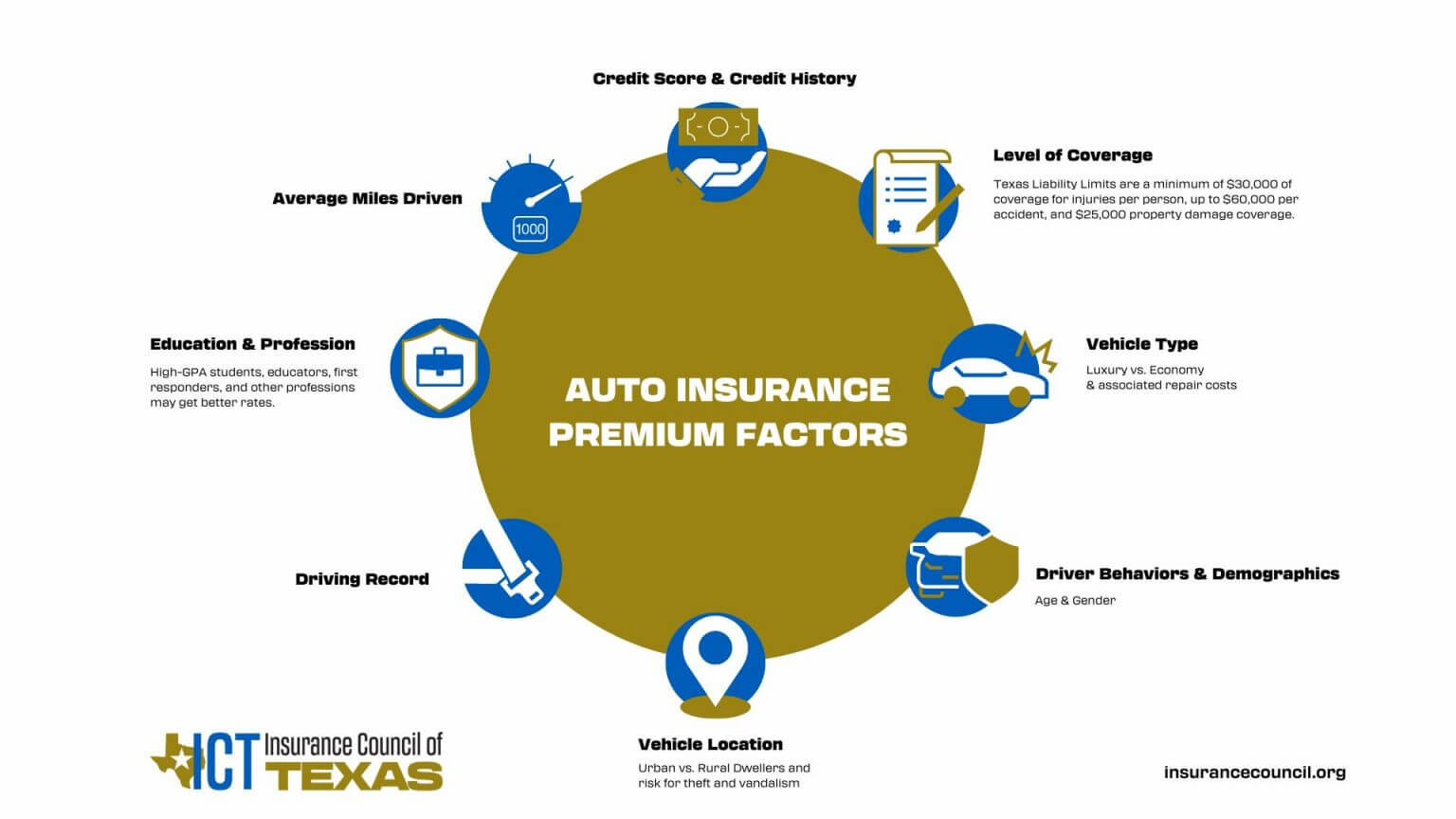

In Texas, auto insurance rates can vary widely depending on factors such as your driving history, the type of vehicle you own, your age and gender, and more. To find the best auto insurance rates in Texas, it is important to shop around and compare quotes from multiple insurance providers. You can also look for discounts such as safe driving discounts, multi-car discounts, and more to save money on your insurance premiums.

Auto insurance is an important investment for all car owners in Texas to protect themselves and their assets in case of an accident. Texas law requires drivers to have liability insurance coverage, but it is important to consider additional types of coverage such as collision, comprehensive, uninsured/underinsured motorist, and personal injury protection to ensure that you have adequate protection in case of an accident. To find the best auto insurance rates in Texas, be sure to shop around and compare quotes from multiple insurance providers.

Filing a Claim

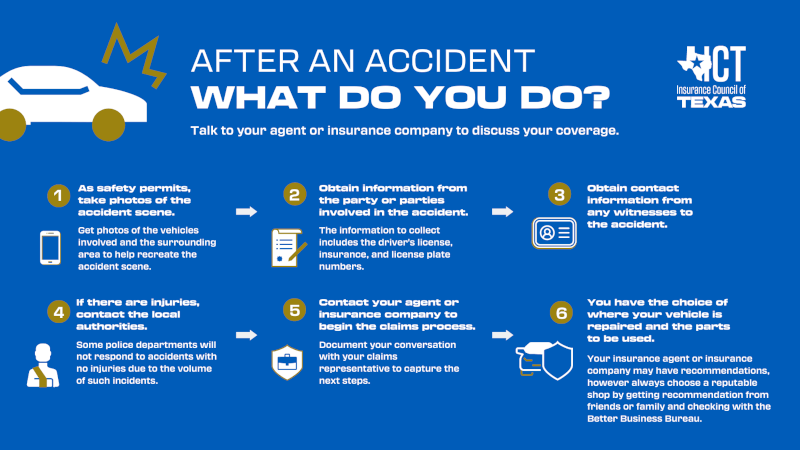

Filing an auto insurance claim in Texas can be a stressful experience, but it is important to do so as soon as possible after an accident or other covered event. Here are the steps you should follow to file an auto insurance claim in Texas:

Contact your insurance company: The first step is to contact your insurance company as soon as possible after the accident or covered event. You can find the contact information for your insurance company on your policy documents or online. Be prepared to provide your policy number and a description of the accident or event.

Document the damage and the other driver’s information: Make sure to write down the exact name of the other driver’s insurance company, company phone number and policy number. Take a picture of the other driver’s insurance card, their driver’s license and the other driver’s vehicle damage. It is important to document the damage with photographs or videos. This will provide evidence of the damage for your insurance company and can help support your claim.

Obtain a police report: If the accident involved another driver or resulted in significant damage, it is important to obtain a police report. This will provide additional documentation of the accident and help support your claim.

Review your policy: Review your auto insurance policy to understand the coverage limits and deductibles for your claim. Make sure you understand any exclusions or limitations in your policy, as this will affect the amount of coverage you receive.

Submit a claim: After you have gathered all necessary documentation and information, you can submit a claim to your insurance company. You may be required to fill out additional paperwork or provide more documentation at this stage.

Await a decision: Your insurance company will review your claim and make a decision about coverage. If your claim is approved, you will receive payment for the covered damages, minus any deductible you are required to pay.

It is important to remember that filing an auto insurance claim can be a complex and time-consuming process. Be patient and persistent in your communication with your insurance company and keep detailed records of all conversations and paperwork. If you have any questions or concerns about your claim, do not hesitate to reach out to your insurance company for guidance.

In Texas, there are certain regulations in place to protect drivers from unfair or discriminatory claims practices. For example, insurance companies are required to provide a written explanation of any claim denial or reduction, and drivers have the right to appeal a claim decision. If you feel that your claim has been unfairly denied or reduced, you can contact the Texas Department of Insurance for assistance.

Overall, filing an auto insurance claim in Texas requires careful documentation and communication with your insurance company. By following the steps outlined above, you can ensure that you receive fair and adequate coverage for your damages or losses.

Auto Insurance Underwriting 101

Auto insurance is mandatory for drivers in Texas, and the underwriting process for auto insurance in Texas involves a thorough evaluation of the driver and the risks associated with insuring them. This process is designed to help insurance companies determine the appropriate premiums to charge for coverage and to ensure that they are not taking on too much risk.

The underwriting process begins with an application, which is completed by the driver. The application includes information about the driver, such as their age, driving record, and type of vehicle, as well as details about the use of the vehicle, such as the purpose and frequency of use. Insurance companies use this information to assess the risk associated with insuring the driver and to determine whether or not to provide coverage.

Once the application is received, the insurance company may conduct an inspection of the vehicle to verify the information provided in the application. This inspection may include a review of the vehicle’s condition, safety features, and any potential hazards or risks that could increase the likelihood of a claim.

After the inspection is complete, the insurance company may request additional information from the driver, such as proof of income or employment. This information helps the insurer to further evaluate the risk associated with providing coverage and to determine the appropriate premium to charge.

If the insurance company decides to offer coverage, they will provide the driver with a quote for the premium. The premium is based on the risk associated with insuring the driver, as well as the type and amount of coverage requested by the driver.

Once the premium is agreed upon, the driver must pay the premium in order to activate the policy. The policy will outline the terms and conditions of coverage, including any exclusions or limitations.

Throughout the policy period, the insurance company will continue to monitor the driver and any potential risks. If the risk associated with insuring the driver changes, the insurance company may adjust the premium or change the terms of coverage.

In Texas, there are certain regulations in place to protect drivers from unfair or discriminatory underwriting practices. For example, insurance companies are not allowed to use a person’s credit score as the sole basis for determining premiums, and they are required to provide discounts for certain safety features, such as anti-lock brakes or airbags.

Overall, the underwriting process for auto insurance in Texas is designed to ensure that insurance companies are taking on an appropriate level of risk and that drivers are receiving fair and reasonable premiums for coverage. It is important for drivers to provide accurate and complete information on their application to ensure that they receive an accurate quote and adequate coverage.

Cost to Repair and Replace Vehicles

Auto Parts Cost Inflation- Pandemic-related supply chain and labor disruptions have exacerbated parts cost inflation. Following accidents, claim payouts are higher due in part to the higher cost of auto replacement parts. According to the Insurance Information Institute (III), replacement cost parts of all parts and equipment for personal auto rose 13.38% in 2022 (as of October 13, 2022).

Cost to Repair- The cost of repairing a motor vehicle as a whole has increased. The Bureau of Labor Statistics price index (CPI), which tracks changes in the prices paid by consumers for a representative basket of goods and services, showed a 12.5% increase in the CPI for motor vehicle body work in 2022. Notably, the cost for motor vehicle body work has increased 42.4% from 2013-2022.

Cost to Replace- The price of new and used vehicles is also increasing. According to III and CPI information, new vehicles were up 10.4% and used vehicles up by 12.7%. Replacement cost for personal auto is increasing due to these higher prices for used and new cars, and car parts. According to the Insurance Information Institute (III), replacement cost for personal auto have risen 10% year over year (as of January 12, 2023). Replacement cost is expected to increase by $886 million in Texas, which marks the third largest increase behind California and Florida.

Rental Car Costs- Many auto insurance policies cover the cost of a rental vehicle during repair. At a time when repairs are taking longer due to supply chain and labor issues, rental car costs are also increasing. According to J.D. Power, the daily rental rate increased 14% in 2022. This increase stems from the pandemic, when rental car companies sold off a sizable portion of their fleets; followed by semiconductor chip shortages and supply chain issues causing lower inventory when the demand increased again.